How Renewable Energy is Poised to Enable the Continued Growth of AI Data Centers

Electricity demand from data centers does not appear to be slowing any time soon. The IEA estimates that data centers could consume 260 TWh of electricity - representing 6% of total power demand – in the United States by 2026.[1] Other experts estimate even higher figures. While much uncertainty around these projections still exists, the consensus is the same: data centers are going to be needing a lot more power, and soon. In the face of reactionary legislation, rising energy costs, ever more scarce land, and long interconnection timelines, direct renewable energy procurement offers a practical solution for two exploding industries.

“Artificial” Forces are Driving Very Real Electricity Demand

The increase in demand for electricity is being driven in large part by generative AI, as it has begun to be used in a wide range of applications. Generative AI’s computational intensity means that data centers hosting the models will be much more energy dense than their predecessors – an AI-powered Google search, for example, requires almost 10x the amount of power of a non-AI search.[2] As AI models get more accurate and become more practical for widespread use by businesses and individuals, demand for power to run them will continue to increase.

This electricity is becoming increasingly more competitive to obtain. In the past, large loads looking to connect to power grids have been able to count on relatively short approval timelines and a clear path to energization. As planned generation supply is dwarfed by planned load demand in many areas of the country, we expect this dynamic to start to change. In 2022, Dominion imposed a brief interconnection moratorium on new data center builds in a section of Loudon County, VA. Certain countries in Europe and Asia have imposed similar moratoriums in the past. With the expected growth as high as it is, there is a risk that similar restrictions could be put in place again.

Beyond interconnection, some cities have even considered limits or bans on data center development. In May of 2024, the city of Atlanta proposed a ban on new data center construction along certain transit stops and the Beltline. Additionally, several states have raised the alarm regarding data centers’ power consumption and have expressed frustration with the tax breaks, preferential power pricing, and other incentives they are eligible for. As historically popular markets become more saturated, local pushback will likely continue to increase, and data center developers may begin to find less traditional markets more attractive from a siting perspective.

Clean Energy Can Solve for More than Just Grid Access

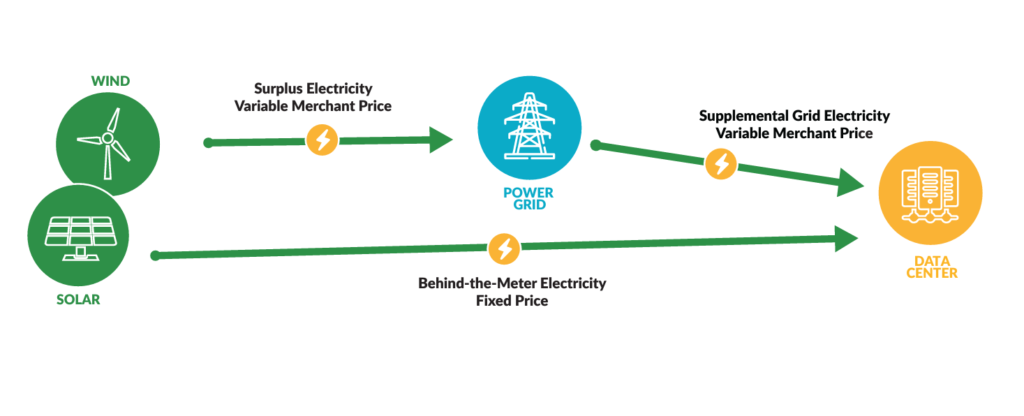

Procurement of behind-the-meter power allows data centers to reduce development, operational, and financial uncertainties. Behind the meter power procurement guarantees data centers access to power, provides long-term price certainty of power costs, solves siting issues, and may speed time to interconnection. While many data center applications require access to power 24/7/365, the variable profile of renewable generation could be a particularly strong fit for AI training functions, which can accept lower latency and less than 100% power availability without disrupting end user experience.

Scout Clean Energy is excited about the possibility of partnering with data center owners, operators, and developers to help solve these challenges and facilitate the AI revolution. Scout is an experienced renewable developer, having built 1.4 GW of projects across the US, with a 19 GW pipeline. Scout is a portfolio company managed by Brookfield Asset Management, a leading global alternative asset manager with approximately $1 trillion of assets under management.

When a load customer signs a Power Purchase Agreement (“PPA”) with a renewable energy project, it provides that load with a fixed-price physical energy hedge. Renewable energy PPAs are long-term contracts (typically 12+ years) and have no upfront costs. These contracts offer certainty for data center buyers for one of their largest operating costs, reduce market risk, and protect against inflation.

A stable geography and a significant amount of affordable land are also priorities for most facilities. Scout projects tend to be located on many acres of land in parts of the country at a low risk for natural disasters. At a typical Scout project, there is enough unutilized land to build additional large commercial facilities, such as a data center. This means that Scout can help solve land acquisition challenges for facilities that do not need to be located in or directly next to population centers.

We understand that data center developers want to build and energize their facilities as quickly as possible to take advantage of the tech industry’s insatiable demand for computing power. Co-location can solve this problem by helping to speed up the interconnection process for the data center in certain instances. In some markets, submitting a load interconnection request behind a generator allows for expedited utility review and approval for the load customer.

Scout has a handful of operating and under construction projects in Texas, and our late-stage development portfolio includes assets there, as well as in Illinois and the Pacific Northwest. This is not an exhaustive list of regions we’re currently active in, but we believe that all these geographies are favorably inclined towards behind-the-meter load. Our expertise in these markets as well as our dedicated Power to X team allows us to help smaller data center developers navigate the interconnection process and work towards a positive outcome for all parties. If you are interested in exploring co-locating your data center load with one of Scout’s projects, please don’t hesitate to reach out today to PowerToX@scoutcleanenergy.com

[1] IEA, Electricity 2024: Analysis and forecast to 2026, January 2024

[2]IEA, Electricity 2024: Analysis and forecast to 2026, January 2024

---

Interested in Learning More?

Fill out the quick form below and our team will get back to you shortly.